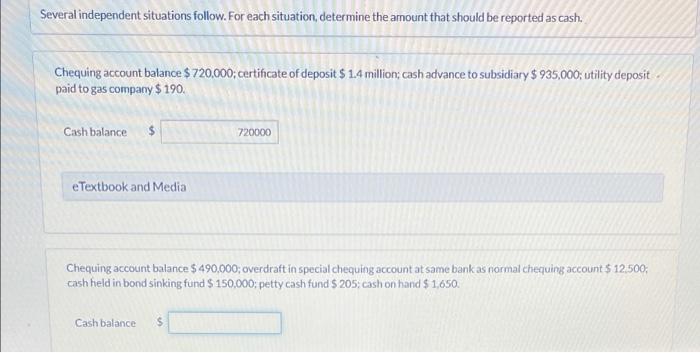

Freshman Affiliate

- #1

We had a home revenue slip as a result of because appraisal appeared right back subject to this new less than requirements, all of our lender consented and as a result we we’re unable to meet the time criteria of the provider to the revenue and had to right back aside.

However the inspector watched the same one thing but indexed all of them given that limited and you can experienced our house was in great condition. We really love it domestic and asked another lender their viewpoint for the appraisal and additionally they told you brand new lower than requirements appear to be an enthusiastic FHA assessment (even though the audience is bringing a traditional financial).

– The latest inspector believed it had been limited and had three decades regarding left life kept if the little is actually complete. The guy necessary setting up baffles which you will repair the problem without mildew and mold removal are expected.

– The inspector produced mention of a few plant growth in the fresh gutters as it could have been some time simply because they was actually eliminated and you can classified it as limited.

– This new appraiser made new appraisal subject to review by a qualified structural company. Our financial altered which in order to an architectural engineer (a lot more costly). I happened to be advised because community architectural are said that is actually whatever they required.

cuatro. The water was not towards the in the course of possibly this new inspection or assessment. My real estate agent managed to get it toward after the examination and there was basically zero leaks but a small tube try discover in the basements therefore got minimal liquids on the ground of the basements.

Therefore the appraisal are thus through with no drinking water towards the due to the fact well, this new appraiser spotted also some some drinking water for the real regarding once we got water https://www.cashadvancecompass.com/loans/student-loans on the in addition to appraisal is made subject to check of your plumbing system of the a qualified company. All of our lender decided.

Do you bring me personally your thoughts on whether do you believe a keen FHA or conventional appraisal is done? It is essential even as we want to try again having additional bank to see if we can fund this family.

Is actually a conventional typically at the mercy of men and women conditions. As i checked on the web from the websites one to said a normal loan wasn’t at the mercy of having such things as cracking decorate, GFCI sites installed when you look at the bathrooms otherwise evaluation of loft. I featured throughout to see if people antique finance is susceptible to the installation of GFCI channels but merely pick pointers you to FHA funds are occasionally subject to one to. Delight render me personally your thinking and you can views. We really are interested in so it household!

Professional Member

- #dos

Top-notch Representative

- #step three

If you find yourself bringing an enthusiastic FHA mortgage the newest appraiser is over-strolled their power. He you should never require monitors toward everything simply to safeguards responsibility.

Professional User

- #4

Freshman User

- #5

Sorry easily wasn’t clear. I am delivering a traditional financing however, got problems with my dated financing administrator and you may wondered in the event the in accordance with the past pointers if the he might has accidentally purchased a keen FHA assessment.

In addition to I forgot to mention your house was a property foreclosure ‘As Is’, which is why there clearly was a rigorous time frame.

Senior User

- #six

Elite Affiliate

- #eight

Product step one “The Bank arranged.” p.s. there’s visible shape and you can undetectable mold in the loft that can be, over the years, traveling into dining area structure; mildew and mold try a health condition not to ever be used gently. I consent that have the Appraiser and your Financial. Item 2 “” Immediately following large moisture and ignored fix explanations leaves progress (visible in gutters and often undetectable below rooftop shingles) in addition, it problems plywood sheathing. I concur that have both the Appraiser along with your Financial. Items step 3 given #step 1 & 2, along with its lack of how much time the newest payment splits in the the new garage foundation have been in existence, the likelihood is rain-water infiltration possess taken place which undermines brand new shelter of one’s slab and you may driveway wall space. I agree with the Appraiser and your Bank. Goods cuatro Regarding absence of people research about how precisely much time water got away from, by the Energetic Day away from Appraisal, I concur with the Appraiser plus Financial. Item 5 “as-is” beauty products deferred maintenance circumstances do not require modification unless they exhibit a medical otherwise security chance. We differ towards writeup on so it product.

Far better learn the hold demands thousands of dollars for the repairs & removal Now vs when you move around in. Yes, he’s things that is to/might possibly be treated for the a normal loan assessment. I’d give thanks to the fresh Appraiser with the opinion, clearly the Lender would agree. That isn’t individual – whether the you’ll be able to consumer is that you or other team, the lending company ‘s the Visitors. I would personally make no choice missing Mold, Roofing system, and you may Structural monitors – IMO, in accordance with the info considering, Prudent Buyers would need views away from Registered experts in men and women 3 sphere before making an educated to shop for decision. At the same time it can also become prudent to go to two almost every other services offered.