Shedding your job is one of the most stressed life events you can sense. And there’s never an enjoyable experience in order to out of the blue wind up out of work. But what happens for those who lose your job if you find yourself within the the center of to buy a home? In the event that you give up on the plans to safe a home loan? Not at all times. You’ve got solutions, and it’s really important to opinion them carefully before making a decision.

Any time you tell your financial regarding the occupations losings?

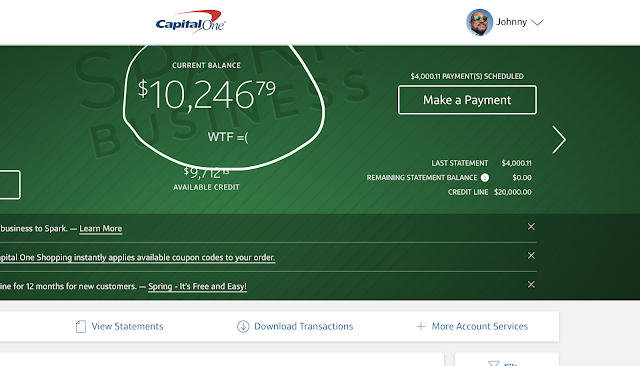

Yes. You need to allow your bank know if your forgotten your job because you will getting signing a file saying all the details about the job are accurate during closing. You can even care that the jobless you will definitely jeopardize the financial software, along with your work losses will present particular challenges. But honesty and you can transparency are crucial and you will crucial whenever using your financial. The faster your tell your how to get a $1000 loan with bad credit bank regarding your state, the earlier they’re able to help you map out a plan.

Might you proceed with your app without a job?

Specific candidates intend to proceed for the software techniques actually in the event they not any longer have a similar a position. In many cases, they may be able inform you he has pretty secure income because of other works or other sourced elements of earnings.

However, even although you can display income stability, you should be prepared for specific hiccups. Without having a similar earnings level as when you used means lenders will feedback the application with additional scrutiny. As well as your odds of protecting financing are down. While every and each condition is unique, you can expect among around three results:

- The job might be delayed.

- Your application having a lesser amount of was acknowledged.

- The job tends to be rejected.

Steps you can take for folks who eliminate your work when you are to shop for a property

For those who beat your job, it is necessary not to disheartenment too. There are measures you might shot keep application for the song. The faster you are taking step, the greater number of your odds of a positive benefit. Here are five activities to do when you find yourself out of work.

step 1. Stop the job

It is essential to-do after you eradicate your work are speak to your bank. Identify your role and ask concerning options available for many who want to move on. Then ask your lender so you’re able to temporarily pause your application as you stick to the tips less than.

2. Safer a different sort of job

Opening an aggressive employment look is crucial. Securing the brand new a career is always to today end up being your concern. Start with upgrading the resume and people on the internet profiles, next begin distributed the expression your seeking immediate a job. Here are some ideas so you can boost your odds of landing work quickly:

- Get in touch with all your connections. Let your loved ones, members of the family, natives and social networking contacts see you’re seeking a position.

- Emphasize your capability to begin with work immediately. This can be a primary selling point so you can companies who want someone to hit the surface powering straight away.

- Most probably to the fresh new field fields. Never curb your look so you can jobs similar usually the one you’re simply when you look at the. Branching out may help you discover a position ultimately. Yet not, something to recall is the fact loan providers basically wanted one get into a similar line of performs for people who has just altered services. They ount of energy.

3. Decrease your loan amount

Your odds of being approved to possess a massive home loan otherwise jumbo mortgage without a job try narrow. not, their bank is ready to agree an inferior amount borrowed. This will need you to put together more substantial down payment or to buy a house having less cost.

cuatro. Pick alternative income supply

Solution earnings source can be breathe lifetime into your app, especially if you are paid down toward a fairly daily basis. Particular lenders tend to consider every sources of earnings that have stability and you may continuity (PDF). Probably one of the most common an easy way to make solution income try to do contract functions, also called gig really works.

With respect to the You.S. Bureau out-of Work Statistics, you’ll find step 1.6 concert economy workers in the usa. Samples of concert work include self-employed services, ride-revealing and bargain works. Even though it is maybe not experienced complete-time work, the Internal revenue service snacks gig functions identical to work environment performs or an effective skilled work job. That have gig functions, you might be in a position to initiate earning profits shorter.

What takes place for those who terminate your loan app?

For most people, this new steps a lot more than may not have a positive influence on their application for the loan. When you are within camp, you have the option to terminate the loan application. While termination might possibly be your last resource, it does help save valuable time and legwork for both you and their potential lender.

If you’re thinking about canceling the application, you could wonder what consequences there might be. Thank goodness their home loan software program is perhaps not a joining price. You may be absolve to cancel when. Yet not, only a few application-relevant charge are refundable. According to the lender’s procedures plus the time of your termination, you can deal with no less than one of the pursuing the:

step one. Missing application costs

Loan applications take time to procedure and you may remark. There are also costs their financial must take in to help you techniques your own application. These charges are usually element of the loan app payment, that’s not often refundable. Additionally, some loan providers costs a financial penalty getting canceling home financing software.

dos. Borrowing from the bank effects

Canceling the application doesn’t effect your credit rating. not, if you submit an application for the fresh finance in the close upcoming, your credit score might take a knock.

step 3. Loss of earnest currency

Based on how much along you’re in the application techniques, you’ve got a small put into the escrowmonly called serious money, so it put generally speaking ranges from one% to 3% of the price. Earnest money shows the seller you may be dedicated to to buy their residence if you are permitting you time to safer financial support. For individuals who suddenly decide to cancel your application, the vendor are eligible to keep the serious money.

cuatro. Other software-associated can cost you

Even though many loan providers promote a number of 100 % free app-related functions (PDF), there are more can cost you that will be generally maybe not refundable. Some typically common for example household appraisal charges and you can price lock charge.

In the event that you terminate their mortgage application?

Losing your work inside home loan app techniques are tiring, you have a variety from options and it is crucial that you imagine them with care and attention. Chat to your own top mentor ahead of continuing. With her, you could potentially review your options so you can build an informed decision.