Are an effective 680, 700, otherwise 720 Credit rating A beneficial? What’s the Improvement?

Among the first articles on this site involved borrowing ratings. It is seriously among first basics out-of individual money you to definitely for some reason, anyone merely neglect. One to blog post, Save Plenty by the Wisdom Your credit score , gives a beneficial macro view of credit ratings and you may exactly what all of the goes into building him or her. This post is planning to diving towards the alot more particular matter from whether or not good 680, 700 or 720 credit score is great.

To many, this is certainly the average get since you should make an effort to become 750+. Although not, if you’re younger plus don’t have very much credit history, this could in fact getting an effective starting point therefore don’t be discouraged. A get out of 650 is really what really institutions consider to be the range anywhere between worst and a good. Very insurance firms a score out of 680 otherwise a lot more than, you are at a performing destination.

The fact is everyone start someplace and more than of your own day our initially credit score is actually much less than just these quantity. Even though you should not freak out, you additionally obviously cannot disregard the state.

What’s Poor, An excellent, and Great?

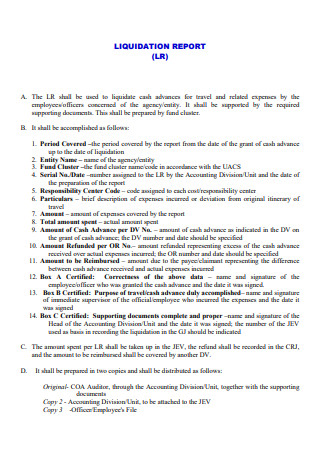

Most of the organization you to procedures otherwise spends credit ratings is going to has other details for just what they consider as poor, a great, and you can high but there are a few overlapping layouts. Regarding article I mentioned throughout the opening paragraph, I released which visualize:

This might be most likely among the best representations of size out of fico scores on the real-world but you will find several deviations.

For 1, specific organizations could have more thinking that’ll set you on the an excellent best otherwise worse bracket. It is essential to note here that in case I say place, I do not always mean banking companies. The reason being more and more people try checking your own borrowing from the bank score. As an example, for folks who connect with inhabit an apartment it probably commonly look at your credit. So it score make a difference to their deposit matter, rent amount, or if perhaps additionally they take on the job to begin with.

Rates of interest

It’s impossible to speak about credit scores rather than discuss the fresh new perception he has got towards rate of interest you will be spending into financing. If you find yourself the rating can determine if you get accepted regarding fantasy flat, the greater and a lot more expensive feeling is when you check out get property.

Interest rates is continued to rise and you may banking companies was firming the latest limits for all those so you’re able to qualify for home financing. The blend of the two something renders with a strong borrowing from the bank rating more importantly.

Don’t let which frighten your no matter if as if your own Beaverton loans get is actually 680, 700, otherwise 720 then i nonetheless believe you’re in a fairly an effective status. What can occurs in the event your bank changed the pace at 700 even in the event? Such as for instance, an excellent 680 credit rating received a great 6% rate of interest and you may a beneficial 720 received cuatro.5%.

For folks who bought a good $one hundred,one hundred thousand, domestic simply how much overall interest can you become paying across the longevity of financing? Right here is the math:

This easy difference between a two% rate of interest will cost you nearly $forty five,one hundred thousand when you look at the interest along the life of the loan. If you’re an excellent 680, 700, otherwise 720 credit history excellent, its not higher plus the best way to get the best interest is to remain improving your rating.

Constantly Just be sure to Replace your Credit score

Every day life is a lengthy-identity game and you can whether or not you adore they or perhaps not, building a credit score are part of your life. Sure, it is a boring situation to think about however, something that will save your self me personally thousands of dollars is an activity that I’m shopping for, and you should be too.