We are not saying the equity route is a bad choice; but every situation calls for a different kind of funding option. For this, you need to look at the pros and cons of each type based on your situation. Regardless of if you are an angel investor or an entrepreneur, the topic of convertible note vs equity impacts you. To begin with, startups prefer convertible notes and angels prefer equity.

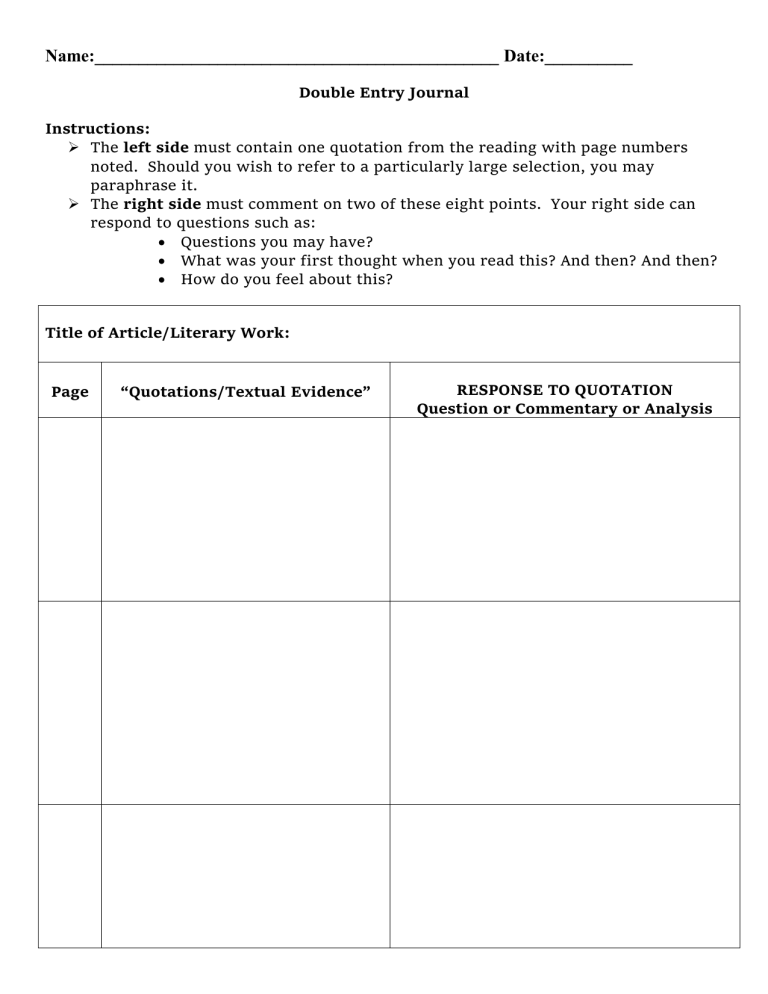

A summary of the different accounting models for convertible debt is as follows:

The discount rate used is an interest rate of a similar debt instrument that does not have the option to convert into shares. Sometimes the issuing companies want to encourage an early conversion of their outstanding convertible bonds. A prompt conversion is generally aimed at lowering the interest cost or improving the debt to equity ratio of the business. Companies try to achieve this by offering to security holders some additional consideration known as “sweetener”. The sweetener is generally given in the form of cash, additional shares of common stock or both.

On Maturity

Companies also need to consider the implications of the new standard on performance measures, whether GAAP or non-GAAP, and other areas of reporting such as debt covenant compliance. The consequences of early adoption and the method of adoption (modified retrospective vs. full retrospective) should be understood prior to discussing the impact of the new guidance with stakeholders. So, we are now five years down the road for ABC Ltd, and the convertible notes are maturing, and the noteholders will have their compound instruments converted into equity.

Significant accounting changes: convertible debt with cash conversion features

The equity component would therefore be the residual, i.e. $600 ($10,000 less $9,400). Either way, though, think carefully through the ramifications, like your own dilution and tax reporting. For help understanding what convertible notes and/or SAFEs would mean for your startup, get in touch. That said, because they have fewer investor-preferred safeguards, they can be a harder sell. In your seed stages, you may need to be flexible and go with what potential investors want. To help you get a firm grasp on how all of this works, let’s talk about some of the details most convertible notes include.

Let us assume that the company Best Services raised its seed funding of $60,000 from an investor – Zed in exchange for a convertible note that has a $6M valuation cap and no discount. When the company reaches its Series A round, it is valued at $12M at a price of $12 per share. Let us assume that the company – Best Inc received $40,000 from an investor – Tony in exchange for a convertible note that has a 20% discount and $3M valuation cap to the Series A round. Now, let us fast forward and move to the time the company undergoes its Series A round.

- This complication is added to by the standard inclusion within the instruments of warrants, calls or puts that we must also consider.

- With this, the post-money valuation is now $1,300,000 and the new investor owns about 20% of the company of the company.

- Sometimes the issuing companies want to encourage an early conversion of their outstanding convertible bonds.

- Regardless of if you are an angel investor or an entrepreneur, the topic of convertible note vs equity impacts you.

It allows the holder to choose between receiving the guaranteed interest on bonds or convert to the company’s share to get the dividend and trade the shares in the capital market. A convertible debt instrument is a compound financial instrument (sometimes called a hybrid), i.e. it has characteristics of both debt and equity funding for a company. As mentioned earlier, convertible bonds are issued at a lower interest rate.

Normally convertible notes act as an “I Owe You”, but instead of paying cash, you will have to pay in equity. As the name implies, ‘convertible notes’ usually result in debt funding being converted into equity, providing the investor with upside returns. However, some convertible notes also have a cash settlement feature which protects the investor from any downside losses where the option conversion feature is ‘out of the money’. Convertible debt instruments are initially recorded at their issuance date fair value, which excludes the conversion feature’s value. The issuer allocates the instrument’s proceeds between the liability and equity components.

Stakeholders should work cross-functionally to ensure proper classification, measurement, disclosure and overall compliance. Proper disclosure and presentation of convertible securities in financial statements provides transparency for users. This enables stakeholders to understand the company’s capital structure and obligations. This section covers key aspects of accounting for convertible securities under U.S.

As a result, in more cases, convertible debt will be accounted for as a single instrument (a liability). We know we will have to bring to account three types of transactions to issue these convertible notes. For simplicity, we ignore transaction costs, freddie mac revolving credit facility legal fees, etc., involved in these transactions. We are just going to focus on the instruments themselves and what accounting entries are required. These types of instruments have grown in popularity over the years, in particular for start-ups.

The amendments clarify that the average market price should be used to calculate the diluted EPS denominator when the number of shares that may be issued is variable, except for certain contingently issuable shares. Additionally, the amendments modify the settlement condition on failing to timely file by clarifying that penalty payments do not preclude equity classification. The ASU also removes certain settlement conditions that are required for equity contracts to qualify for the derivative scope exception, which will permit more equity contracts to qualify for the scope exception. Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee (“DTTL”), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities.

In addition to the instrument at the time of issue specifying the price and timing of conversion, it will also set out the types of shares in the company the holder will be entitled to gain control over. With this in hand, all you need to do is fill in the details for each convertible note on the Eqvista application. Once you fill in the details, it will be recorded and the calculations would be handled by the application on its own. Let us assume that there is a maturity date 5 years from the date of investment in the company. If the company hasn’t had a preferred round within this time, the investor can demand their money bank.