The decision to declare bankruptcy try a difficult you to. But it is often very important to the individuals up against challenging obligations, providing them with a chance at a brand new economic initiate. Case of bankruptcy have consequences which affect your bank account.

For more information about how bankruptcy proceeding make a difference to your financial coming, simple tips to rebuild the credit after declaring case of bankruptcy, as well as how a bankruptcy lawyer may help, get in touch with Sasser Attorney now getting a free appointment.

Filing for personal bankruptcy may have greater-varying outcomes on your financial upcoming, the latest details of and that rely on which chapter you document under. The 2 most common style of bankruptcies is actually:

- Chapter 7 bankruptcy – For the a bankruptcy proceeding discover possibility of the loss of non-exempt assets making sure that continues can be applied to pay financial institutions. For the majority chapter 7 cases the latest borrower could probably exempt almost all their property and therefore really chapter 7 cases is actually no-asset instances. A chapter eight is found on your credit score to possess 10 years. Generally a borrower can obtain credit cards and auto loans soon after case of bankruptcy albeit with the reduced good conditions than some one which have a borrowing. A borrower generally speaking should hold off 24 months from discharge in order to be eligible for a traditional financing with no help of a good co-borrower that have a good credit score.

- Chapter 13 bankruptcy proceeding – Known as reorganization bankruptcy proceeding, Part 13 comes to restructuring your financial situation and you can starting a want to pay them out-of more than a particular period of time unlike attempting to sell any of your property. A chapter 13 submitting is also stay on your credit history to have around 7 ages. As with chapter 7, following filing off an incident, this new debtor’s ability to access top quality borrowing from the bank could be limited to own the initial year or two to the disease gradually boosting as the new debtor uses consumer credit and you may prompt will pay towards his otherwise the girl membership.

Whichever sort of you decide on, this new relative affect creditworthiness would-be a purpose of just how good the credit rating was ahead of the case of bankruptcy. In case the credit history is already bad then impact tend to become limited. Plus, coming creditworthiness can be off little transfer to some as well as significant transfer so you’re able to other people.

Obtaining Fund Immediately after Bankruptcy

What is very important to remember when trying to get a loan immediately after personal bankruptcy is that your credit score tends to be different than in advance of. You’ll likely manage to find loan providers that happy to help you. But not, often times, a collector often charges large rates of interest and you will/or need big off payments.

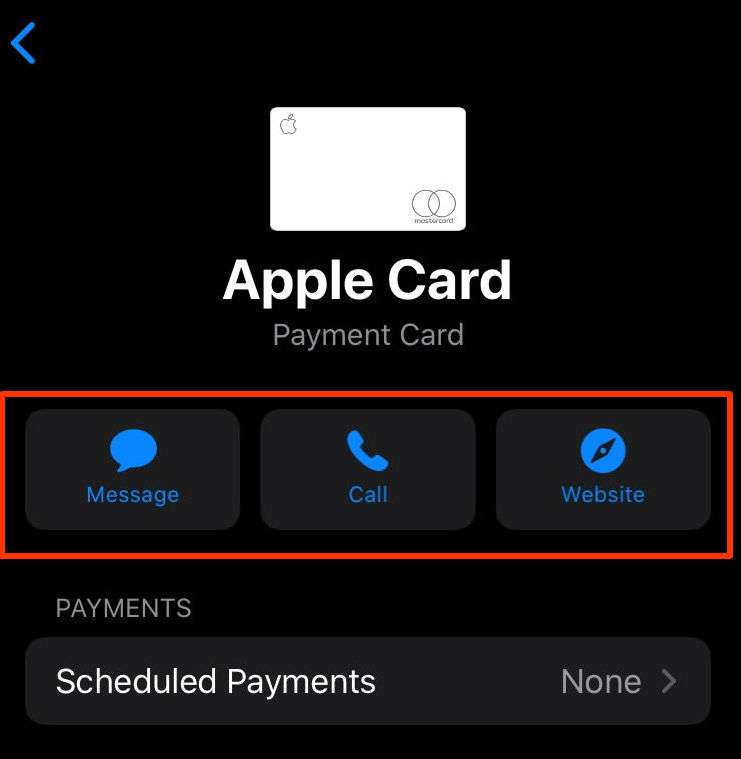

It is vital to remember that bankruptcy will remain on your own borrowing from the bank statement to have 7 in order to 10 years. Attempt to work on reconstructing your own borrowing with this time through regular payments on time and you can preserving your stability lowest. You ought to has 2-5 user cards that you apply and also make timely payments toward in order to rebuild your credit score with. It is smart to getting traditional and you will responsible with your mastercard usage.

Another important grounds to look at when making an application for that loan shortly after bankruptcy proceeding is the kind of loan you are applying for. Very loan providers are more inclined to reveal to you short playing cards, secured finance, or other style of smaller loans to people having dinged credit. If you’re looking having a mortgage loan, you might have to hold back until your credit score possess enhanced.

Reorganizing The manner in which you Means Your finances Just after Bankruptcy

Obligations troubles can feel difficult. Develop, personal bankruptcy permits you a whole lot more framework and you will satisfaction regarding debt (age.grams., lease, tools, eating, dresses, insurance, etc) and left expenses (e.grams. house mortgage, car loan, student loan, an such like.)

A good start inside the restructuring your money immediately after bankruptcy proceeding was carrying out a spending plan to help you track your expenditures and you can ensure that you are spending what you are able manage. Be sure to tend to be offers goals on your finances so as that you can begin building up their deals levels and you can making certain monetary cover.

You may also need certainly to opinion your credit rating and you can imagine getting a number of credit card/money. This can help you rebuild their borrowing from the bank and have loan providers one to youre in charge and you can able to handle loans. Which have in charge economic government, you can reconstruct the borrowing from the bank over time.

How can an attorney Help?

A talented case of bankruptcy attorney makes it possible to see the outcomes out-of filing for bankruptcy, decide which chapter best suits your circumstances, and help you navigate this new records and you can legal procedures of this the process. In the Sasser Law practice, we realize that offered bankruptcy proceeding will likely be stressful. We’re dedicated to delivering quality legal sign and you will permitting all of our subscribers make the top behavior because of their financial futures. All of our lawyer will explain the results away from filing for personal bankruptcy and you will work with you to understand more about solutions to your advantage. We’ll address any questions you’ve got in regards to the legal standards regarding filing for case of bankruptcy, eg wisdom credit ratings, development a repayment bundle, and dealing with financial institutions.

At the Sasser Attorney, we have been pleased with the more than two decades of expertise and you may the new 10,100000 people and you will small enterprises i have assisted through bankruptcies and almost every other financial hardships. E mail us today having a free visit more resources for how exactly we may help and you will just what solutions can be available to your.

- Towards Publisher

- Latest Posts

For more than 2 decades, the new Sasser Attorney might have been helping some one and you may entrepreneurs go through financial difficulties to see the light which shines at the end of canal. All of our New york installment long rerm loans no credit check Blue Mountain MS bankruptcy proceeding attorneys are all panel-specialized pros, which means i’ve passed a complex examination, been through an extensive peer opinion, and you can continue steadily to secure judge knowledge loans contained in this ever before-developing section of laws.