Credit score Not available: The risk-centered prices see is not required in the event the step one) a credit score is not offered, 2) a credit history isnt taken from other user reporting company, and you can step three) a credit score different notice is provided on the applicant

In 2003, the truth that Act started golf ball moving to the 2011 guidelines included in section of Regulation V which affect financial institutions just who provide exposure-situated costs. Risk-dependent price is when a creditor kits a rate (or other credit terms) considering a customer’s likelihood of low-percentage.

Choosing who gets shorter positive conditions may actually end up being some complex which can be most likely a discussion for the next time. However, discover basically one or two an effective way to determine smaller favorable terms: 1) The credit rating proxy means and you may dos) the fresh tiered rates means. Really don’t have to purchase at any time within these a couple alternatives, as most are able to get inside the laws, which i will explain within the a little bit.

Today, establishments offering chance-built rates provides most revelation standards from inside the part of Regulation V where they need to provide a beneficial risk-founded rates see to certain customers. There are cuatro various other chance-based-rates design versions that might be put, most of the included in Appendix H of Control V:

Model function H1 is for include in complying to your standard exposure-built pricing find criteria in the Controls V if the a credit score is not included in form the information presented terms of borrowing from the bank.

Design mode Hdos is for exposure-situated rates observes provided regarding the membership review in the event the a beneficial credit history is not utilized in raising the annual percentage rate.

Model setting Hsix is actually for use in complying into the general exposure-based prices observe standards in the Sec. if a credit score is employed within the setting the information presented terms and conditions from credit.

Design form Hseven is for chance-based prices observes provided to the membership feedback if the a good credit rating is utilized into the increasing the annual percentage rate.

While this may sound pretty easy, it’s rather hard to follow as we need to differentiate anywhere between the individuals users that had shorter good conditions after which supply the sees appropriately. Thank goodness for people, the very last code didn’t become that it hard.

Anything we must discover regarding the risk-based-costs rule is the fact congress produced a very difficult requirement and you will the new Government Put aside had written the laws in a way that is convenient and that fundamentally assists creditors bypass the newest code. This occurs inside the element of Control V, and therefore covers exclusions into the exposure-based-pricing revelation. This area essentially provides six exceptions for the chance-based-prices observe:

App for Specific Words: Basically, when a customers gets terms they removed, the danger-based-costs observe is not needed.

Negative Action See: If the an adverse action observe that has had FCRA data is agreed to a customers, a risk-dependent cost see is not and required.

Money Secure of the Domestic A residential property: The chance-depending prices notice is prevented when the 1) the loan was shielded by one to four systems out of residential real-estate and you will dos) if the a credit score exception see is provided to all the users trying to get borrowing from the bank secured because of the you to definitely four gadgets off residential a residential property.

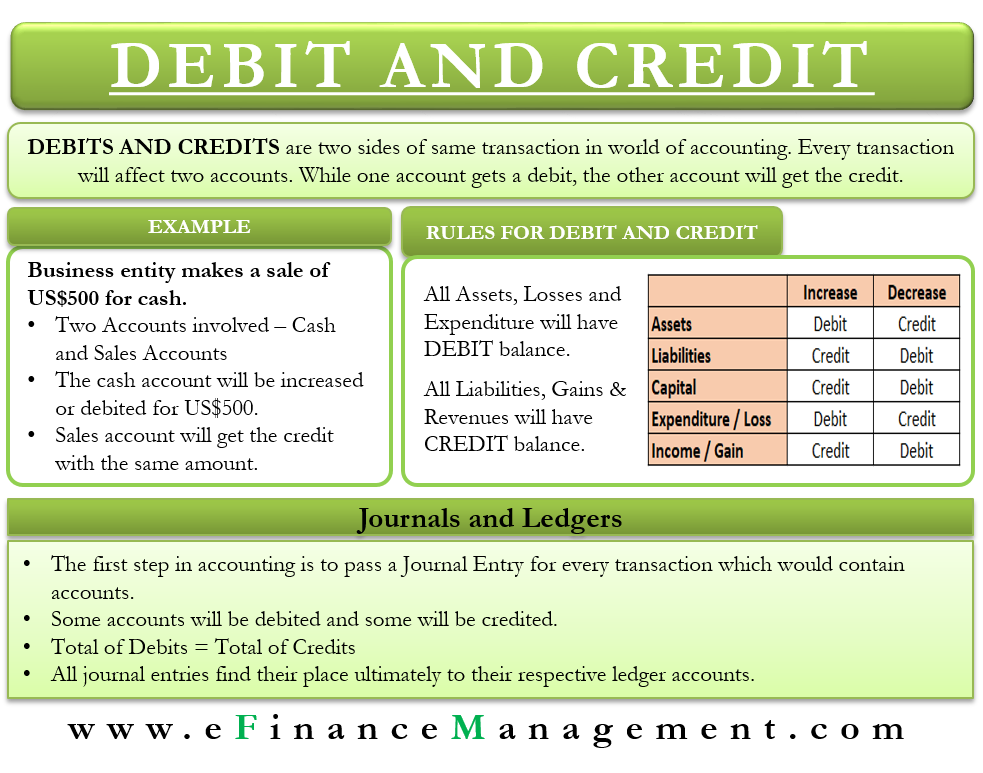

Generally, pricing are high of these with a minimal credit score if you’re a knowledgeable prices are merely available to people who have good credit rating

Almost every other Extensions regarding Credit Credit rating Disclosure: The risk-created prices see would be prevented towards if the 1) the mortgage isnt shielded by the that four gadgets from home-based real-estate and 2) in the event that a credit history exception see exists to all the people making an application for comparable borrowing from the bank.

- Model function Hstep three is for include in experience of the financing rating revelation exception to this rule to own finance protected of the domestic houses .

- Design mode H4 is for include in exposure to the financing get disclosure exception to have loans that are not safeguarded of the home-based real-estate.

- Design mode H5 is for use in connection with the financing score revelation difference whenever zero credit history exists having a consumer.

So, to close out this, the chance-mainly based rates observe is not required if a credit rating difference revelation (variations H-3, H-4, otherwise H-5) is offered. In short, really loan providers generally get around the danger-based-cost signal https://availableloan.net/installment-loans-mo/oakland/ by providing a credit score different see to any or all.

Although this data is helpful for creditors having risk-built prices, we must as well as glance at the conditions of these FIs that don’t enjoys chance-built cost.

In the event the a loan company cannot need risk-depending prices, it is important to keep in mind that you may still find revelation conditions to own mortgages. The Fair Credit scoring Act (FCRA) contours regulations within the area 609(g) that need an alerts in order to home loan candidate. Specifically, so it laws requires anybody who can make funds and you can uses a customers credit score concerning the a software (open-prevent otherwise closed-end) initiated of the a customers to own a consumer purpose that is shielded because of the 1 so you can cuatro units off domestic real property ought to provide 1) disclosures needed in subsection f (disclosures out-of credit ratings) and dos) a notice in order to financial applicants.

In a nutshell, this can be a beneficial disclosures that includes things like the financing rating of your candidate, the range of you can results, important aspects you to negatively influenced the financing get, the brand new go out of your get, while the label of the individual or organization you to provided brand new rating.

The pre-amble toward 2010 governing claims the second: Appropriate the means to access design setting H-3 otherwise design mode B-step 3 is even intended to be agreeable towards disclosure one to may be required below area 609(g) of your FCRA.